- Blog

- |Managing Payroll

- >PAYE and Tax

- >Tax of a Premier League footballer

How much tax does a Premier League footballer pay?

If there's one thing we all know here in the UK, it's that football is definitely coming home!

Indeed, to say our great nation is a little football-mad would be an understatement. Maybe it's because we invented the sport back in 1170. But if there's one thing that's certain it's that football truly is England's national sport.

And that got us thinking here at PayFit, about footballer salaries, naturally and their take-home pay. After all, when you've got your head in tax and NIC calculations all day, you tend to start thinking about these things.

Many of us have heard about the exorbitant salaries of Premier League footballers; however, very few of us understand just how their salary is broken down, or how much they actually take home for bringing it home.

So let's take a peak at what Premier League footballers actually make, and how much of this actually goes to the taxman.

But first...

Quick disclaimer

Before we get started, it's important to note that the salaries we'll reference in this piece are based on information widely available online. In reality, these may vary.

In addition to that, the purpose of this article isn't to shame any of the parties mentioned! We're simply a very curious bunch here at PayFit and like digging into how these things might work, hypothetically from a tax and NIC point of view.

Lastly, we've based our calculations on the assumption that any party mentioned is paid as an employee through PAYE. So these will always be just an estimate.

How much tax do people pay?

To understand how much tax a footballer would pay, it's first helpful to at how UK-based employees are taxed.

The amount of tax someone pays will vary depending on how much they earn. This amount is also affected by the tax code belonging to that individual.

Tax codes indicate how much of a person’s salary is free of tax. The most common tax code in the UK is 1257L. Someone with this tax code would receive £12,579 for their Personal Allowance. This means that the first £12,579 they earn would be completely tax-free and, consequently, would only pay tax on money above this amount.

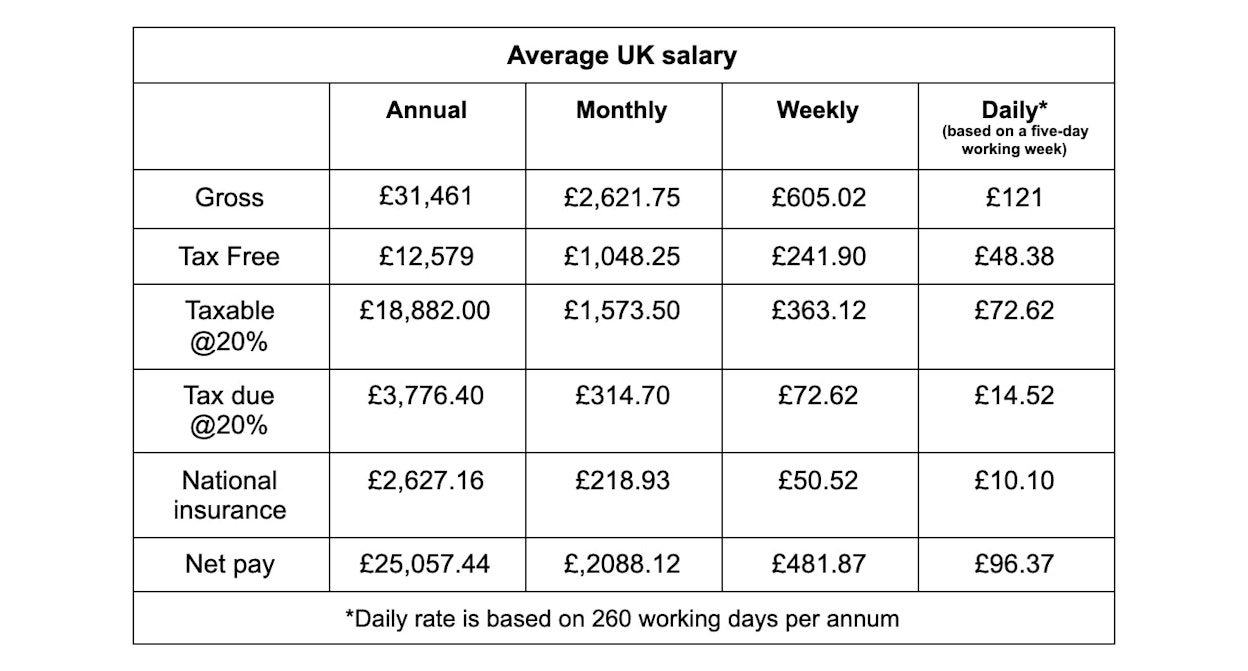

An employee earning the average UK salary, £31,461, and with the 1257L tax code, would have their salary broken down as shown in the table below.

| | Annual | Monthly | Weekly | Daily* | |---------|---------|---------|-----| | Gross | £31,461 | £2,621.75| £605.02 | £121.00| | Tax Free | £12,579 | £1,048.25 | £241.90 | £48.38| | Taxable @ 20% | £18,882.00 | 1,573.50 | £363.12 | £72.62| | Tax due @ 20% | 3,776.40| £314.70| £72.62 | £14.52 | | National Insurance | £2,627.16 | £218.93 | £50.52 | £10.10 | | Net Pay | £25,057.44 | £2,008.12 | £481.87 | £96.37 |

From the original £31,461 annual salary, £12,579 would be completely tax-free. This means that an employee would only pay tax on the remaining £18,882.00.

They would be taxed 20% of this, equalling £3,776.40. The NICs would be an additional £2,627.16, meaning that the employee would take home £25,057.44 in net pay during the year.

The 20% tax rate is also referred to as the basic tax rate and employees earning up to £50,270 a year are taxed at this rate. Money earned above this amount is taxed at 40% (higher rate). There is a third tax bracket, also referred to as the additional rate. Any earnings above £150,000 are taxed at 45%.

How much tax does a Premier League player pay?

According to the Global Sports Salary Survey, the average pre-pandemic salary for a footballer playing in England’s Premier League was a staggering £60,000 a week.

Did you know?

The average salary of a Premier League footballer pre-pandemic was £60,000 a week. This works out at over £3 million a year pre-tax.

The table below breaks down how much a footballer would pay in tax and NICs. We’ve also split the earnings into the different tax brackets to show how much of the salary is taxed at the varying rates.

A £60,000 weekly salary equates to just over £3.1 million annually. Anyone earning that amount of money would not be entitled to a Personal Allowance.

From the £3.12 million annual salary, £37,700 would be taxed at 20%, and £112,300 would be taxed at 40%.

The remaining £2.97 million would be taxed at 45%.

Altogether, someone earning this amount would pay £1,388,870 in tax and an additional £66,278.84 in NICs. This would leave them with a net salary of £1,664,761.16.

What about the super-rich players?

While a £60,000 weekly salary may be the average in the Premier League, some players — particularly the best ones — can be on an awful lot more.

The Premier League’s highest earner is Manchester City playmaker Kevin de Bruyne. He rakes home a staggering £385,000 a week and over £20 million a year pre-tax.

The highest-earning Englishman, Raheem Sterling, earns roughly around £300,000 per week and, pre-tax, £15.6 million per year.

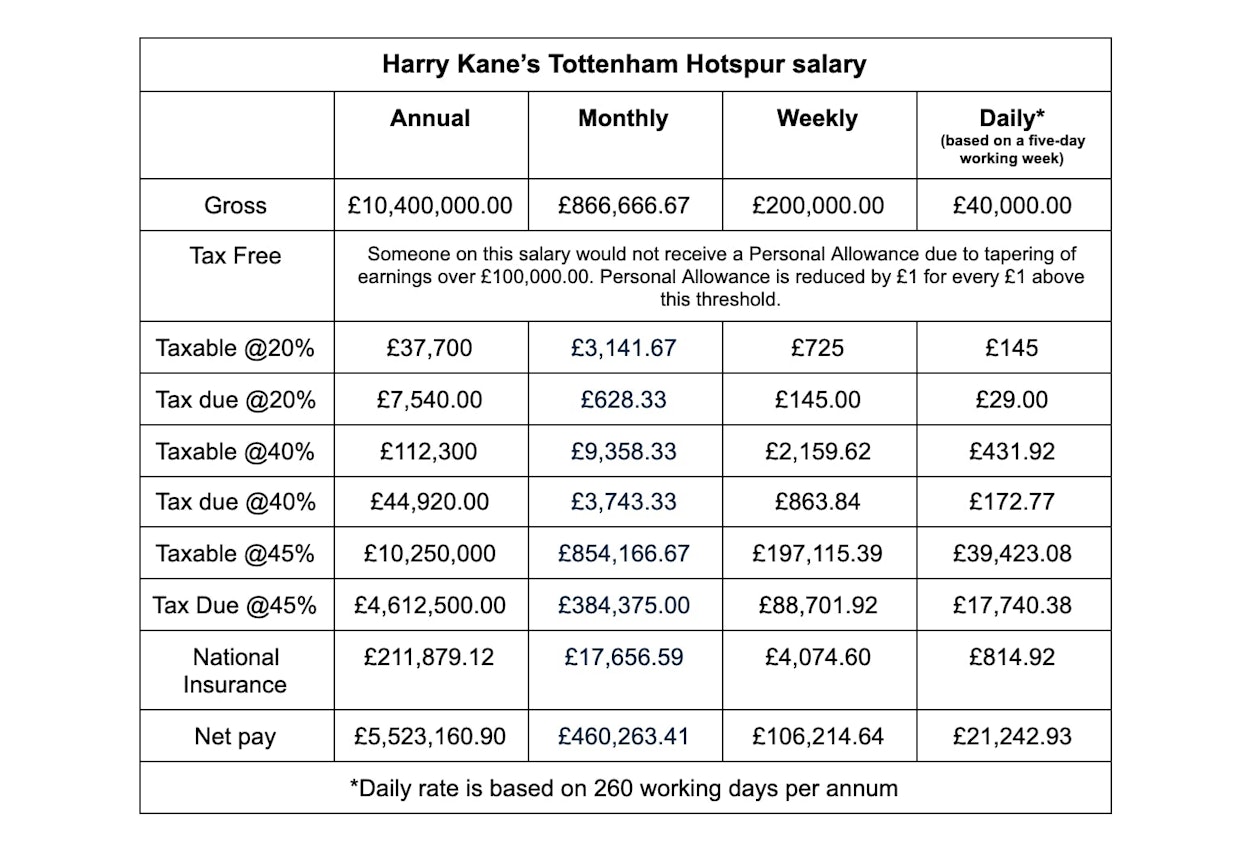

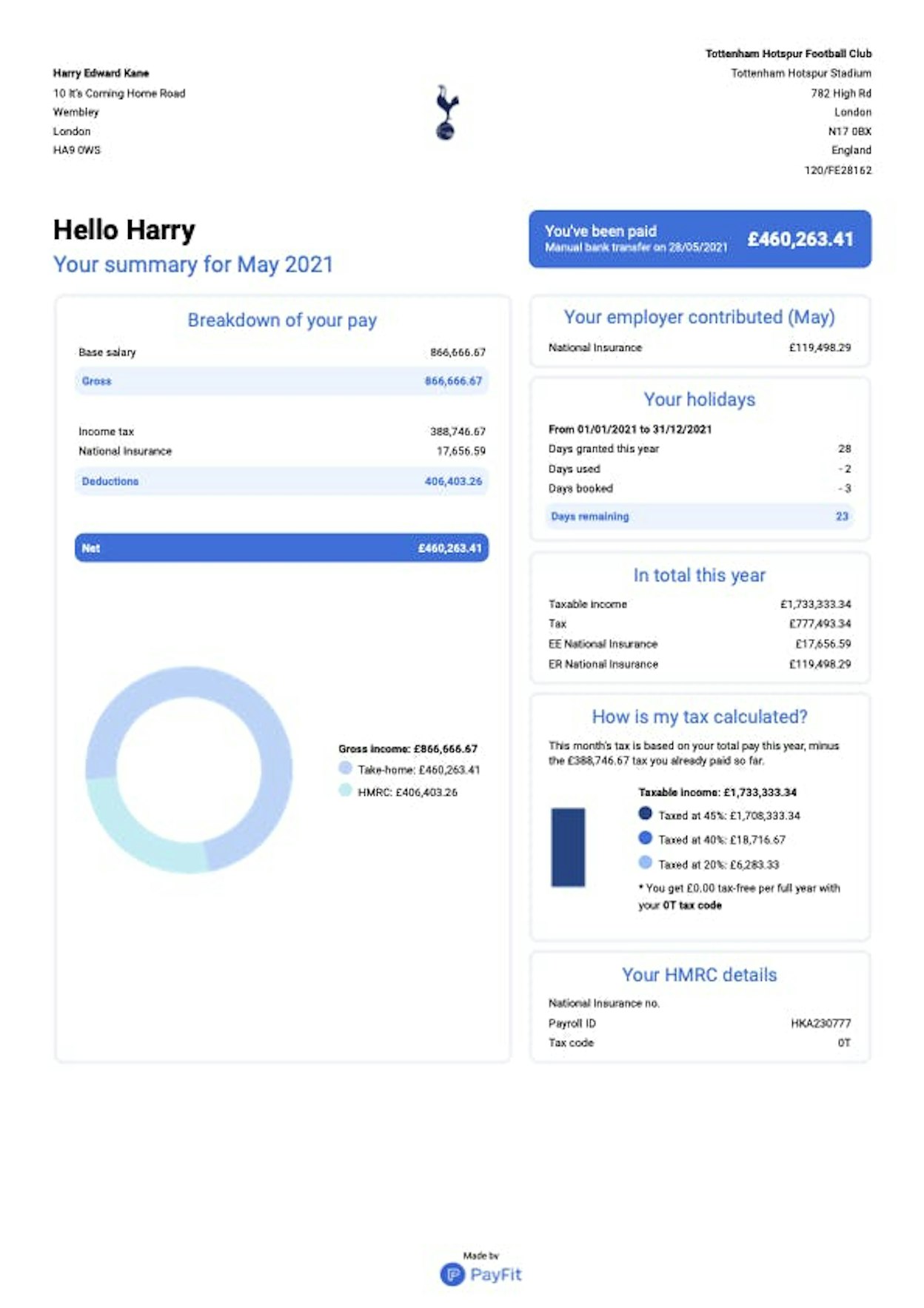

England’s talisman and captain Harry Kane is said to be on about £200,000 a week. This gives him an annual salary of £10.4 million pre-tax.

To help understand Kane’s earnings, we’ve produced a table detailing how much he receives annually, monthly, weekly, and daily.

From Kane’s original £200,000 weekly earnings, he would take home £106,214.64. The remaining £93,785.36, including £4,074.60 NIC, would be taken by the taxman.

Over the course of the year, Kane’s £10.4 million annual salary would leave him with a take-home pay of slightly over £5.5 million. The amount of tax and NIC paid would be just under £4.9 million.

What is PayFit?

PayFit is a cloud-based payroll and HR platform that helps businesses of all sizes manage and automate their payroll and HR processes.

We consider ourselves a hybrid software that combines the best of in-house — control and visibility — and outsourcing — expertise and specialism — in an all-in-one platform.

The 2024 UK National Living Wage - An Employer’s Guide

The Cost Of Recruitment In The UK - What You Might Not Know

UK National Insurance Changes for January 2024

End Of Tax Year 2023/2024 - Eight Key Changes For 24/25

Strategies to Reduce Employee Turnover