- Blog

- |Managing Payroll

- >Payroll

- >the risks of outsourcing payroll

What Are the Risks of Outsourcing Payroll, and What’s the Alternative?

Things don’t have to be this way. That’s our message to you if you’re currently outsourcing your payroll, or considering whether to take that approach.

Look, we get it - paying someone else to take care of everything for you is an attractive proposition. But outsourcing by its very nature means relinquishing a huge degree of control and insight to somebody else. And it may be that you’ve accepted some of the drawbacks that come with outsourcing as being an unavoidable part of the package, or that the positives outweigh the negatives. That’s also totally understandable.

But when it comes to your company payroll, the risks of outsourcing are perhaps more pronounced than in other areas of business, not least because we’re talking about ultra-sensitive, personal financial data. Just imagine if that inherent lack of control meant staff members being paid late or incorrectly or, heaven forbid, a data breach or identity theft episode at your outsourced provider impacting your company.

Wouldn’t you rather be in control of such business-critical things yourself?

Here, we’ll cover the risks of outsourcing payroll and present the case for smart software investments to help address some of those risks. If you’re looking to empower your team to do its best work, or wondering how to choose the right software in the first place, then read on.

Can you put up with the pains of outsourcing?

As a business, you may well consider the benefits to outweigh the risks of outsourcing. Payroll’s not something that you want to trouble yourself with personally, right? That’s something for the accountants - let them deal with it so you can focus on managing and growing your business. Sure there’ll be some hitches along the way - waiting a bit longer than you’d like for a report or having to query some of the data, for example - but nobody said payroll was all plain sailing, right?

Let’s take a look at some of those niggles that might well be manageable for a time, but after a while could lead to more serious consequences.

The back and forth

Getting the information you need from your outsourced payroll provider means asking them for it. And this means sending an email, or picking up the phone. You might get an out of office, or a voicemail. You may have to wait several hours (or even days) to get a response. And, once you do get that response, it might not be quite what you needed or expected. Which then means having to repeat the whole process.

If you found reading that paragraph a bit of a drag, imagine actually having to do it. Multiply that across lots of different queries, and it quickly becomes clear how much time and energy this needlessly wastes.

This points to one of the central risks of outsourcing - precious time that could’ve been spent on impactful tasks being wasted.

Mistakes in the data

The potential for mistakes being made increases as additional communication steps are added into the mix. For example, your email or voice message might get passed via an internal messenger to the person actually doing the data gathering, meaning the message could get misinterpreted. And if your outsourced provider is using outdated software or manual processes to manage your payroll and make complex calculations, the chance of mistakes being made intensifies.

Not getting the insight you’re after

This particular risk of outsourcing payroll tends to rest on the reporting capabilities of your outsourced provider’s payroll software - if they use software at all for that matter. Indeed, some third parties still do everything manually using spreadsheets - chaos!

It may be that you’re looking to forecast the total cost of employees for the year ahead so that you can budget accordingly, or analyse any gender pay gaps across the business so that steps can be taken to remove them. Perhaps you’d like to assess National Insurance contributions within a particular department, or understand the pension contributions for a particular set of employees.

At best, it could take time to get back what you’re looking for. At worst, your outsourced provider simply won’t be able to provide the data in a presentable or actionable format, or the information provided will be incorrect.

You’re not their number one priority

Outsourced payroll providers such as accountants or payroll bureaus will likely be managing payroll for a large and complex base of companies. Your business is but a small fish in a very large pond, and despite assurances of excellent customer service, there’s no guarantee that the demands of other clients won’t come before yours.

This can be immensely frustrating, and is one of the risks of outsourcing that isn’t often taken into consideration.

A fragmented tech stack

The same can be said for this particular issue. Your outsourced provider may well be managing your payroll effectively, but it’s perfectly plausible you’ll be running pension platforms, HR software or leave management platforms yourself in-house.

Splitting your HR and payroll tech in this way means that the platforms in question won’t be talking to each other, which can create confusion as the data is literally all over the place. In an ideal world all of your platforms will either integrate or sync with one another, meaning more complete and insightful reports, seamless movement of data between payroll and accounting platforms and less time spent trawling through multiple places to find what you’re looking for.

A lack of control

As you can probably see by now, all of these payroll outsourcing risks are linked - a kind of domino effect, if you will.

The back and forth in communications and data, mistakes, and lack of insight, together with not feeling prioritised, quickly leads client teams to feel that they lack control over their payroll processes.

It’s not just a feeling, it’s reality. And after a time that reality can start to have repercussions across the wider business. Let’s take a look at what some of those are in the next section.

Can you afford what the risks of outsourcing might ‘cost’ your business…and you?

What outsourcing your payroll costs you, your team and your business can be measured in much more than simply money.

Indeed, it surely won’t be long until the frustrations listed above start to have a knock-on effect on other parts of your organisation.

A knock on effect on other processes and departments

Causing stress and resource churn within the HR, finance or leadership team is bad enough, but when the risks of outsourcing payroll start to manifest themselves across the wider business, it’s double trouble.

It’s a particularly burning issue for a small business, when time is already stretched as staff are expected to muck in with lots of different tasks and processes. The more of the organisation that is dragged in to resolve errors, chase the outsourced provider or pull extra data from in-house software, the less time its staff has for initiatives to run and grow the business.

Stressed, disgruntled staff

And then there’s your employees.

As the negative effects of outsourced payroll creep into other departments, pulling them away from their core responsibilities, wellbeing and morale can take a hit. As an HR team, or business leader, this is the last thing you want.

We’ve written before how 20% of British workers surveyed by CIPP said they have left a job as a result of being paid late or incorrectly. This is another risk of outsourcing payroll that comes as a consequence of the data mistakes, outdated manual processes and pressure on resources that we’ve already covered.

Making poor decisions

Getting bad data, or being made to wait for it, can lead to bad, rushed, or incorrect decisions being made. This could be something relatively trivial like having to reimburse an expense after the end of the month as it wasn’t added to an employee’s payslip. Or it could be something more significant, such as reporting incorrect Real-Time Information (RTI) to HMRC as the result of a calculation error.

The risk of making poor decisions is significantly reduced if you have immediate access to a wide range of accurate data, something which is difficult to achieve under an outsourced arrangement that relinquishes control to somebody outside of your company.

What’s the impact of carrying on as normal?

Hopefully by now you’re starting to appreciate how quickly the risks of outsourcing payroll can rear their head. So whether it’s an approach that you’re considering, have just embarked upon, or have been letting chug along in the background for some time, it could be the moment to break away from the status quo.

There’s just a few more dominoes left to fall, and then we’ll get to the good news, we promise!

The difficulty in identifying and correcting errors

This one is related to the lack of control and time spent going back and forth. By the time you spot the mistake, it could be too late to correct it, for example an underpayment to an employee who had worked overtime towards the end of a given month.

Owing to the issues with communication already described, it may take a day or more to get somebody on the case. The team member in question could become frustrated, anxious and distracted from their work.

When you don’t have instant access to the data yourself, or direct control over it, it’s tricky to see and then correct those errors.

Eroding trust

When your staff don’t feel confident that those in charge have control of the ship, you’ve got a problem. The key to attracting and retaining the brightest talent is instilling confidence and trust. If late or incorrect payments become a regular occurrence, or your staff are encountering a regularly flustered HR or leadership team, then that stress and frustration starts to take root across the business.

The long and short of it is, if your people can’t trust you to pay them accurately and on time, then they’ll start to look for a company that can.

How to choose the right software

But fear not, for there is another way - one that puts you back in control, provides better insight, reduces the time you’ll spend worrying about payroll and empowers your people.

That way is payroll software.

Choosing the right payroll software can be a daunting task, but with a little time and research into what the needs of your business are, can be a hugely rewarding undertaking.

When looking into payroll software as an alternative to outsourcing, it’s all about choosing a tool that will help you do the opposite of all the stuff we have described above.

So that means:

automation : automated calculations, with HMRC compliance coded in;

integration : such an important one! You want your payroll, HR, pensions, accounting and leave management tools talking to one another, allowing you to move and assess data from one software into another with no manipulation;

reporting : customisable reports that can be put together with a few clicks, and presented in a visually engaging and actionable way;

security : differing permissions between managers and team members, plus elements such as two-factor authentication;

UX : an easy-to-use platform that can be understood and used by those with varying degrees of payroll knowledge;

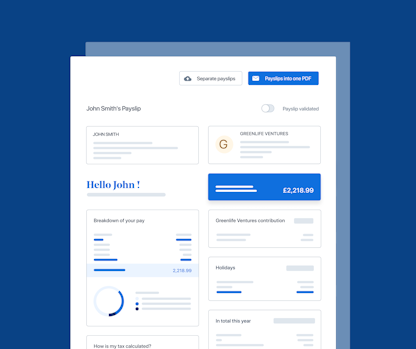

employee access : giving your staff access to information such as payslips, bank details and annual leave allowances means less questions for your team, and more empowered employees.

If you can tick off the above points, and invest in the right software, then you will quickly start to see those complications that come with outsourcing consigned to history.

Download our guide on how to choose the right software using the link below, including information on how PayFit specifically can help you take control of your payroll destiny.

The 2024 UK National Living Wage - An Employer’s Guide

The Cost Of Recruitment In The UK - What You Might Not Know

UK National Insurance Changes for January 2024

End Of Tax Year 2023/2024 - Eight Key Changes For 24/25

Strategies to Reduce Employee Turnover