- Blog

- |Managing Payroll

- >Payroll data

- >Payroll journals

A Guide To Payroll Journals - and How PayFit Facilitates a Smooth Process

Payroll journals are a vital aspect of running payroll. They provide details on how much a company is spending on its employees each month, including gross wages, National Insurance contributions, pensions, benefits and so on.

As simple as it may sound, manually extracting the data from a payroll journal and transferring it to your accounting software isn’t the easiest of jobs. But when it comes to accurately reconciling and accounting for all costs associated with compensation, it’s essential your payroll and accounting processes are in sync.

Not only do manual calculations come with the risk of errors and inaccuracies, and the knock-on effects those entail, but having to tinker with payroll journals so that they are compatible with your accounting software wastes needless time and resources.

Thankfully, there is a solution to these long standing woes.

In this guide, we’ll answer the question: ‘what is a payroll journal’, run through the typical payroll journal entry process and illustrate how the compiling, exporting and uploading of payroll journals into your accounting software is so much easier with payroll software like PayFit.

What is a payroll journal?

Payroll journals are documents, typically in CSV or Excel format, which show details on how much a company is spending on its employees in a given pay period. They are typically accessed at the conclusion of that particular payroll run, so weekly, fortnightly, four weekly or monthly, depending on the accounting software you are using. They are used by finance teams to reconcile and account for all costs associated with compensation.

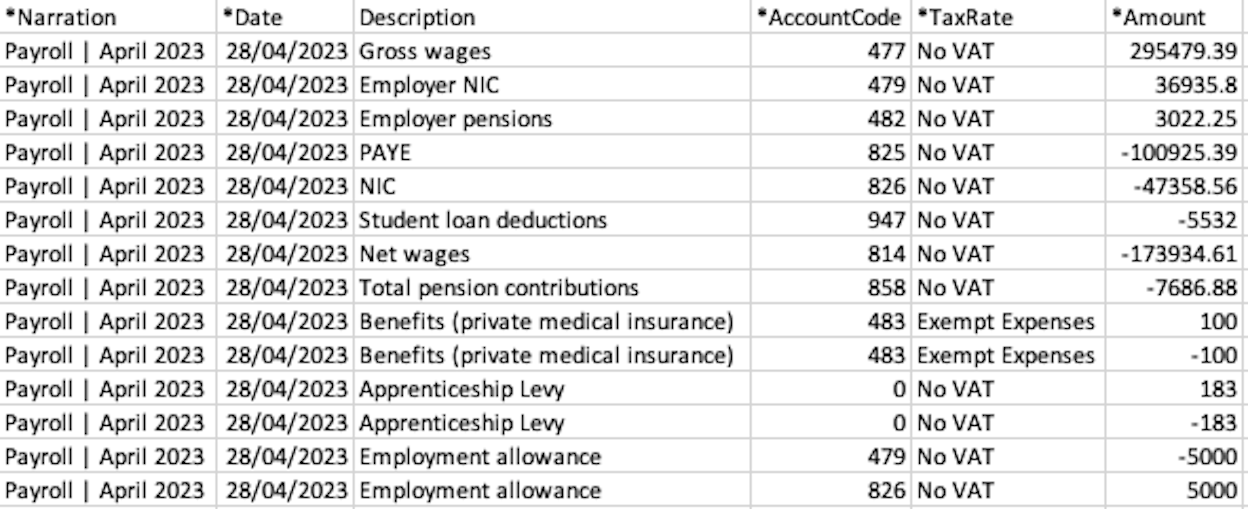

As you can see from the example payroll journal below, they include both positive and negative figures (i.e:. credits and debits). When formatted correctly, the debit and credit amounts will be equal, so long as everything has been processed correctly.

In the past finance teams would have wasted hours if not days formulating payroll journals from scratch by manually creating a spreadsheet from payroll reports. What’s more, this would usually come at an additional cost - including a set-up fee plus recurring fees every time the journal is produced. This is still a reality for companies relying on accountant-run payroll.

Not only is this counterproductive, but it presents the risk of mistakes happening (more on this later).

So what does a payroll journal look like, and what’s included on one?

The key components of payroll journals

Below you’ll see an example of a payroll journal, downloaded from PayFit in a format that can be uploaded directly into Sage Business Cloud Accounting without making any changes whatsoever (more on the other platforms we sync with later).

There will be small differences for other accounting software platforms - for example the debit and credit values separated out into two columns, or columns being named differently, but this is a good example of a standard payroll journal.

It shows each line item at company level (i.e.: a combined total for all employees). In PayFit, journals can be downloaded and displayed at company, department (cost centre), or individual level.

The columns in this example are as follows:

narration : this shows the pay period the journal applies to, in this case April 2023, however it doesn’t necessarily always refer to the pay period;

date : the pay date;

description : the item of credit or debit (e.g.: gross wages / pension contributions);

AccountCode : also called a nominal code, a number that is used to refer to a particular description item - this can be assigned automatically or edited by the user;

TaxRate : whether or not VAT is applicable

amount : the total cost of that description item, in this case across the whole company but also available by department or individuals.

PayFit Top Tip

A quick reminder - payroll journals downloaded from your payroll software will look slightly different depending on which accounting software you choose when creating your report. However, the components included within it are broadly similar.

What are payroll journal entries?

We thought it best to briefly mention payroll journal entries, as it’s a phrase often associated with the topic. A payroll journal entry is simply a line item entered into a payroll journal (e.g.: the gross wages for the company in the month of April), and therefore is associated with the traditional, more manual process of recording costs related to employee compensation. A series of payroll entries, such as gross wages, employer NIC, pensions and student loan deductions, make up a complete payroll journal.

How have payroll journals been processed traditionally?

Much like many traditional finance and accounting tasks, the payroll journal of the past would have been created manually. This involved calculating all line items such as gross wages, NICs, pensions etc. in a spreadsheet using payroll reports - which, again, would have been calculated and created manually.

Surprisingly, many companies are still operating in this way, eating up the days of those doing the calculations, with the added pressure of making mistakes due to human error.

Additionally, having to tinker with payroll journals so that they are compatible with and ready to upload into your accounting software wastes needless time and resources.

How does this compare to managing payroll journals using PayFit?

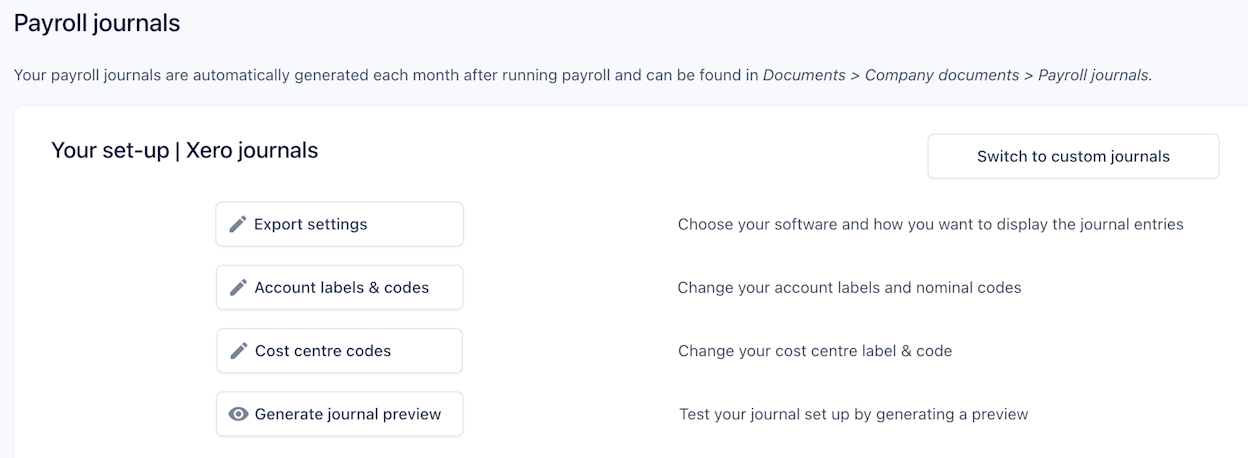

With PayFit, payroll journals are generated automatically each month when running your automated payroll. Using our handy new search bar feature, you can navigate directly to the setup page, as well as access all historical payroll journals, with one click.

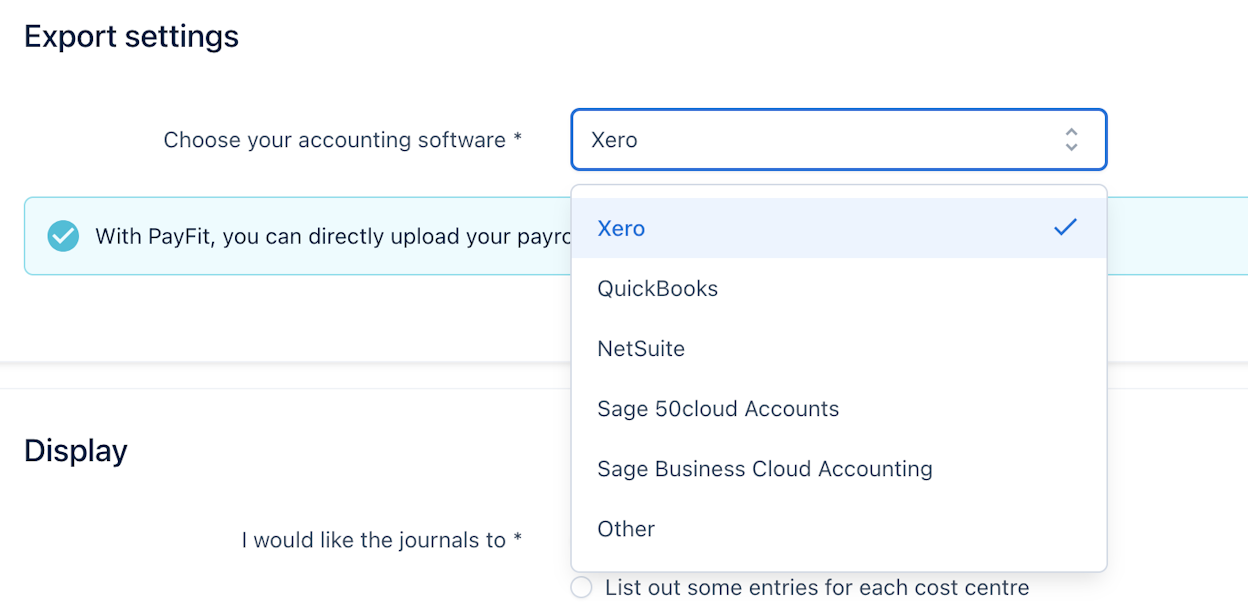

The only manual stage of the entire process is the initial setup - including choosing which accounting software you want your journals to be synced with, specifying account labels, nominal codes and cost centre labels, and how you want your journal laid out (by company, cost centre of individual). New pay items or cost centre costs will need to be added in manually, but this is a relatively quick and straightforward process once the initial setup has been completed.

Once that’s all set up, simply navigate to the Documents section, find the relevant journal and hit download. Payroll journals are generated automatically each time you run payroll, and can be formatted to be compatible with Sage Business Cloud Accounting, Xero, NetSuite, QuickBooks and Sage50cloud Accounts, with custom journal formats available for creation should you use a different solution. Easy right?!

The outcome is that time spent integrating payroll journals can be reduced by up to 80%. And let’s not forget all the stress you’ll save yourself and your team by reducing the risk of errors and freeing up shed loads of time for more strategic, fulfilling and business-impactful work.

Reporting by cost centre - the PayFit difference

The ability to have your payroll journal broken down by cost centre allows you to see exactly where your employee costs are being allocated. This is great for looking at individual project costs, so for example how much the project management team cost vs. the engineers involved in the same project.

You might want to assess the impact of training across the business, and whether the cost of the knowledge managers providing the training justifies the outcomes.

Or it may be that you’re looking to attribute certain pay items to a particular cost centre, even if the employee in question is part of a different cost centre. This is particularly useful where a member of a particular department (e.g.: operations) has helped out in another (e.g.: IT), let’s say if somebody was off sick.

PayFit helps you achieve this, with customisable cost centre codes meaning you can attribute the cost to the department in which the work was done.

Creating a payroll journal manually from your payroll reports is hard enough, but imagine trying to segregate the data by department or cost centre. This is something that PayFit allows you to do automatically in a few clicks.

Keen to see our payroll journal feature in action? Why not book a quick demo of PayFit with a member of our team?

The 2024 UK National Living Wage - An Employer’s Guide

The Cost Of Recruitment In The UK - What You Might Not Know

UK National Insurance Changes for January 2024

End Of Tax Year 2023/2024 - Eight Key Changes For 24/25

Strategies to Reduce Employee Turnover