- Blog

- |Managing Payroll

- >Payslips

- >Payslip of the Future

The Payslip of the Future

Everybody loves payday. Seeing your bank balance topped up and knowing that there's money to burn. It's a good feeling, right? But what about the payslip itself? Could that offer more?

We at PayFit think it can!

Over the last few years, a lot of companies have already made the shift from paper-based to online payroll meaning that employees are now able to view their payslips online.

While this shift can only be seen as a positive development, payslips themselves continue to be somewhat old-fashioned in their design and underused in their potential to educate and inspire employees.

Payslips can be a powerful tool. After all, nearly everyone who works and earns money receives one. Yet, despite this, only six out of ten UK adults who regularly check their payslips say they understand everything on there.

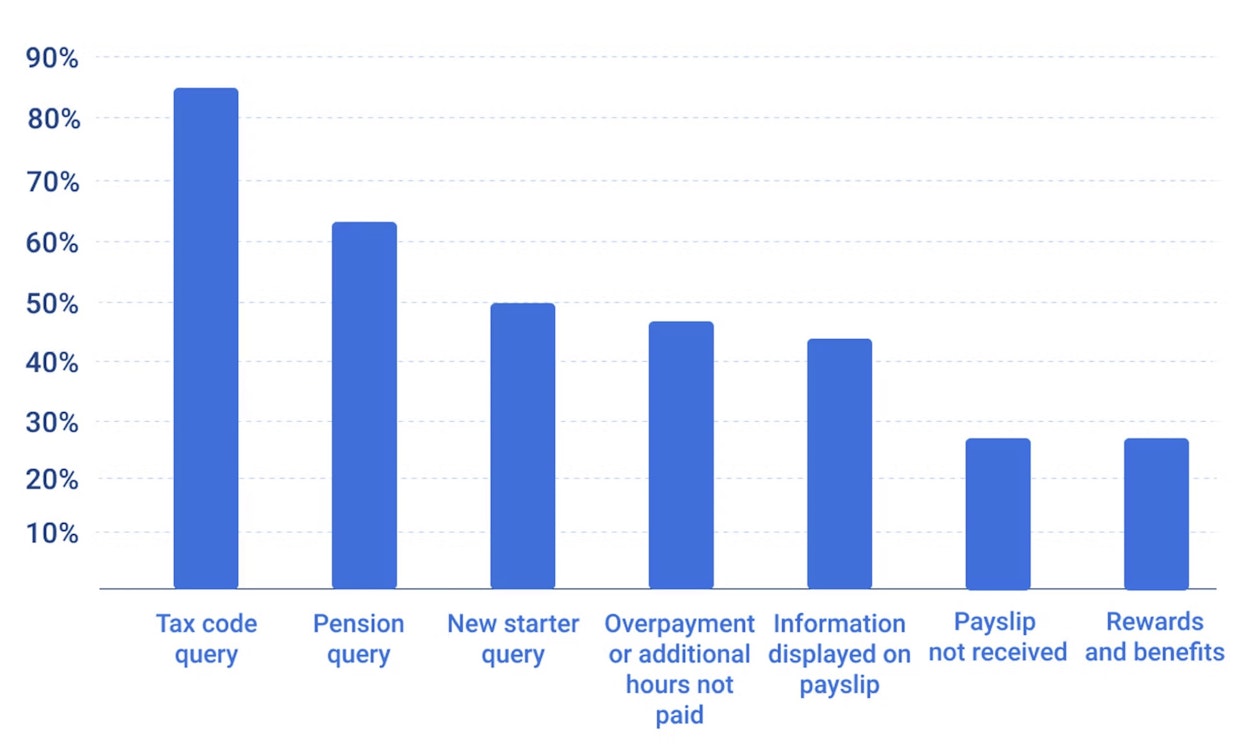

This figure is not necessarily all that surprising, particularly when put into context with the results obtained from payroll professionals surveyed in CIPP's Future of Payroll Report 2019.

When asked "What are the most common types of enquiry into the payroll department?" over 42% of respondents listed queries relating to information displayed on payslips.

But what does this figure suggest? Does it mean payslips themselves are unclear?

In all probability, yes!

According to Mitrefinch's The Future of the Payslip Report, 63% of respondents stated that they understood how the items on their payslip were calculated; however, 21% found the terminology and information displayed to be confusing.

Again, this shouldn't come as a huge shock. Payroll is a complicated subject. Its ever-changing nature, monthly fluctuations and variations between organisations and employees can mean that many struggle to get their heads around what's printed on their payslip.

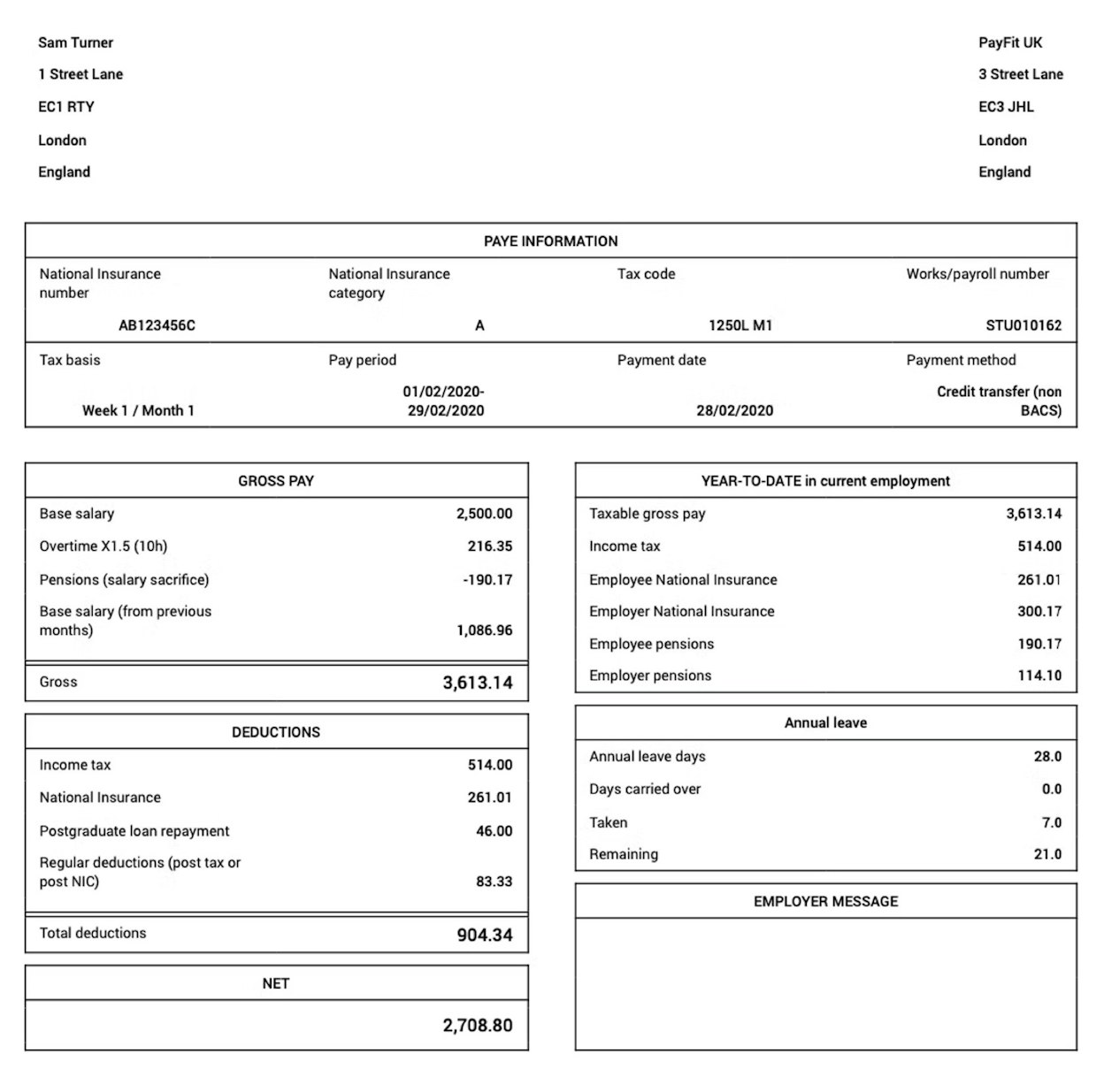

With payslips like the one shown below the current norm, it is perhaps not altogether that shocking that regular members of staff with no prior or existing knowledge of payroll can find them a little difficult to understand.

What do people want from their payslip?

Mitrefinch’s report reveals that employees want additional information on their payslips, particularly calculations in relation to tax and absence entitlements. Nevertheless, the survey also revealed that many people believe the current payslips they receive offer little value outside of just confirmation of being paid.

Respondents complained of a “powerlessness” over their payslip leaving them feeling like there is no point in trying to understand things in greater detail.

This is obviously disappointing, as is the fact that only 3% of those surveyed said that they felt proud of their payslip and believed that it reflected the work they put in.

Figures such as these are concerning and point to a clear disconnect between employees and their payslip.

So, what can payslips become?

We believe that they can be more than just a mere summary of payments and deductions and instead act as a bridge between employers and employees.

While the first thing most people (84%) look for on a payslip is their net pay, the number and diverse nature of queries received by payroll departments suggest that there is a lot that can be done to improve people’s understanding of their payslip.

The results also demonstrate that there is interest among employees to learn more. Over 50% said that they would be keen to access guides on specific parts of their payslip.

So, does this suggest that what’s holding employees back is not a lack of interest in the subject but instead poorly displayed information?

If that is the case, what can be done to simplify payroll and help employees to understand their payslips better?

What can be done to make payslips easier to understand?

At PayFit, we've long thought that the world of payroll doesn't get the spotlight it deserves.

Okay...we're maybe being a little facetious, but we do honestly believe that there is potential to make payroll and in particular payslips, far more exciting, user-friendly and accessible.

Over the last few months, we've conducted both external and internal surveys to establish what employers and, more importantly, employees want to see displayed on payslips.

Thanks to the data collected, we've been able to produce an innovative new payslip design that looks to address the pain points shared by employers and employees.

1. Clarity of information displayed on basic payroll items

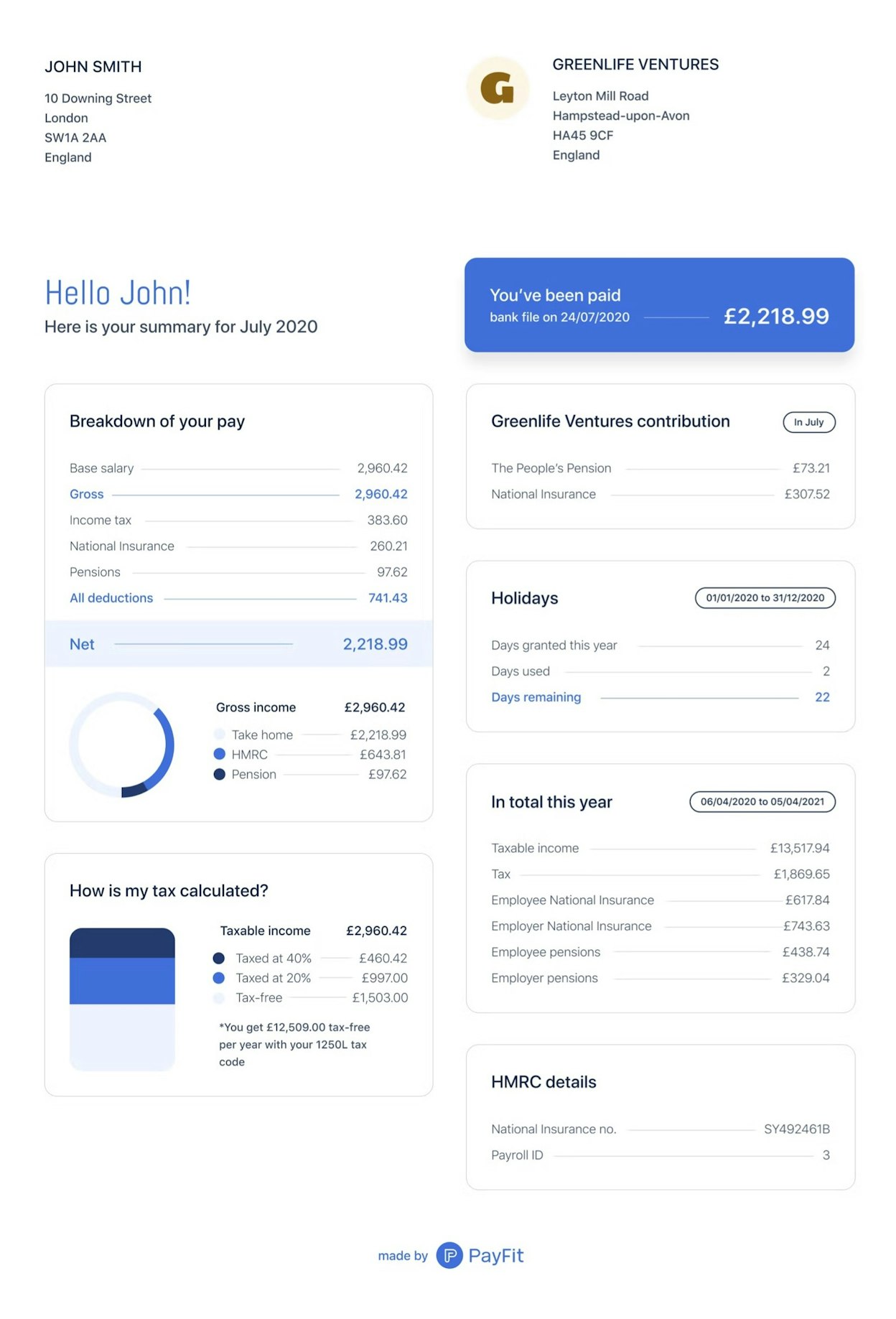

Because 84% of people say the first thing they look at on their payslip is net pay, we’ve clearly highlighted the net pay at the top of the payslip with “You’ve been paid” displayed along with the date and type of payment.

The breakdown of the employee’s monthly gross pay is clear and includes all key deductions such as National Insurance contributions (NICs), pensions, student loans or even deductions corresponding to employees buying shares.

2. Increased transparency between employer and employee

There is no requirement for payslips to show employer contributions; however, we have decided to include this on our payslips moving forward.

For example, employer contributions such as pensions and NICs are displayed so that employees are aware of the overall cost of employment to their employer.

Employees will also be able to see how much their employers are providing in the form of non-cash benefits. This has been added to provide more clarity to employees and improve the overall transparency of the employer-employee relationship.

3. Tax calculations explained

Tax calculations are complicated and fiddly things.

This is why we have displayed how an employee's tax is calculated. Each payslip now includes a breakdown of an employee's taxable income, including how much of it is taxed at which rate.

As previously mentioned, the most common query that payroll departments receive is related to tax codes.

We've chosen to go one step further and include information about the employee's tax code and explain how much of their monthly salary is free of tax!

4. Visibility on year-to-date totals

Some, but not all, payslips display a breakdown of the year to date (YTD) earnings — e.g. tax, NI and pension contributions.

We have added this to our revamped payslip to ensure that employees can track their total tax and NI payments as well as pension contributions from April to March.

For employees repaying their student loans, the new PayFit payslip will display how much they've contributed throughout the tax year.

5. Annual leave summary

The remodelled PayFit payslip now displays how much annual leave an employee has already taken, how much they have remaining, and what they have booked in the future. This has been done so that employees can stay up to date with their holiday entitlement.

6. Better communication tool and improved employer branding

According to Mitrefinch, 55% of those surveyed said that there was a distinct lack of company branding on their payslip.

Sadly, it is often the case that payslips lack personalised company branding and, as a result, brand identity.

But employers and employees needn’t fret! Our new design includes a company's logo meaning that when employees access their payslip through the PayFit portal, their employer's logo will be visible on the top of their payslip.

Impact for employers

When designing our new payslip, every decision was taken to improve the employee's payroll experience.

Through these changes, we believe that we can help provide better information on basic payroll items and improve transparency between the employer and employee when it comes to pay.

Finally, we predict that through these changes, employers will be able to see a reduction in the number of pay-related queries that they receive each month.

Are you interested in finding out how PayFit can improve your company's payroll processes? Why not book a demo with one of our product experts?

The 2024 UK National Living Wage - An Employer’s Guide

The Cost Of Recruitment In The UK - What You Might Not Know

UK National Insurance Changes for January 2024

End Of Tax Year 2023/2024 - Eight Key Changes For 24/25

Strategies to Reduce Employee Turnover