- Blog

- |People management

- >Annual leave and absences

- >Calculating holiday pay

How to Calculate Holiday Pay For Staff

Calculating holiday pay is a challenge that almost every company faces on a monthly basis.

Working out how much employees are entitled to, especially when dealing with part-time workers, zero-hour contracts, or missing data for that 52-week period, isn’t exactly a walk in the park. In fact, it’s enough to make some HR managers cry out: ‘I need a holiday!’.

The issue is complex, and that’s reflected in the number of employment tribunal cases that have cropped up over recent years, leading HMRC to reassess how holiday pay should be calculated.

So, how do you calculate holiday pay? Especially in cases where things aren’t so clear-cut. We’ll cover it all.

How to calculate holiday pay

Let’s start with calculating holiday pay for regular full and part-time employees (will get to term-time and irregular-hour contracts in a bit). Working out pay here starts out pretty simply - it’s their average weekly pay. In other words, to work out how much holiday pay this kind of employee should be paid:

1. Count back the number of weeks they worked in the past 104 weeks, up to a maximum of 52 weeks.

2. Add up what they've been paid in those weeks worked, up to a maximum of 52 weeks.

3. Divide the sum from Step 2 by the number of weeks from Step 1

(Pay+overtime, commissions, bonuses) X number of weeks worked = weekly holiday pay

Essentially, an employee shouldn’t be paid less while on holiday than when they’re working regularly. But as mentioned before, that gets complicated a little by the type of contract an employee is on.

Now, many people assume that this calculation should be based just on an employee's base salary. But, in reality, this can look a little different depending on whether an employee is on fixed or irregular hours or receives regular overtime, bonuses or commissions.

And that’s where things get more complicated - when you’re faced with scenarios that look different from the traditional 28-day entitlement. Here, employment law isn’t as straightforward and, in fact, can be a downright minefield, with individual interpretations of rulings differing from case to case.

PayFit Top Tip

Another thing that can complicate holiday pay calculations is that 4 out of the 5.6 weeks entitlement fall under EU law while 1.6 weeks come from UK law. That 1.6 weeks can be paid at the employee’s contractual pay rather than their average pay (that is, without including additional bonuses and commissions). Despite this, most employers will keep things simple and apply the most favourable calculation to the full 5.6 weeks entitlement. The UK government was already considering merging the entitlement to create one single block but decided against this in order to keep the two separate rates.

Holiday pay calculation: different scenarios

Let’s go over a few of the most common scenarios you might run into over calculating holiday pay and how to handle each.

When in doubt, use the pay reference period

The pay reference period is the last 52 weeks we referred to before. It’s the length of time an employer must look back at an employee's variable earnings to determine the correct average pay for annual leave. To correctly calculate the pay reference period, employers must take the 52 paid weeks and divide all earnings in that period by the total number of hours that an employee has worked. This figure can then be used to calculate an employee's holiday pay.

Even if an employee's pay rate does not vary from pay period to pay period, it is best practice to adopt this approach for all regular workers.

Employees with fixed (or regular) hours

You can work out weekly holiday pay for employees on regular hours pretty simply - you simply pay them what you normally pay them in a week.

However, where regular bonuses or overtime are paid, the 52-week pay reference period needs to be used to calculate an employee's average weekly earnings.

What about part-time workers?

Holiday pay for part-time workers, or pro rata holiday entitlement is based on the same principle as entitlement for full-time employees, just adjusted for the amount of the holiday year they’ve worked.

So if you have a worker that works the same amount of hours every week, just part-time, their holiday entitlement would be 5.6 times the hours or days they work in a week, and their pay adjusted accordingly.

Find out more about holiday entitlement for part-time workers.

Employees who don’t have fixed hours

Employees under this category are typically on what’s commonly known as zero-hour contracts.

So, how do you calculate holiday pay if you have no fixed hours to refer to on a weekly basis?

Employers have two options here - to use accrued bank holiday entitlement or to calculate pay or roll up holiday pay.

This last option, rolled-up holiday pay, used to be illegal but was made lawful again after the latest consultation.

If going with the accrued bank holiday entitlement method, this would amount to 12.07% of hours worked each pay period. If going the rolled-up route, it would be 12.07% of pay received in that calendar month, paid out as rolled-up holiday pay.

If the worker is taking statutory parental or sick leave, entitlement is calculated based on average hours worked over the last 52 weeks, including weeks not worked. While pay is calculated based on the average pay over the last 52 weeks, excluding weeks not worked.

Employees who haven’t been working the last 52 weeks

Now, there might be times when an employee or worker has been on long-term sick leave or, for whatever reason, hasn’t been working the last 52 weeks. Or you might be dealing with a newly onboarded employee who hasn’t yet worked a full 52 weeks.

In this situation, there are a few factors to consider:

Where calculating holiday pay for someone who’s been off sick, you can work backwards (but no further than 104 weeks) and use remuneration figures for a maximum of 52 working weeks.

For new joiners the last 52 weeks, there may not be enough data for a full 52-week average calculation. In this case, you can pro rata their holiday entitlement. So, for example, if they’ve worked 20 weeks, work out their average pay over those 20 weeks.

Fixed hours, but irregular pay

As we covered before, some workers on fixed-hour contracts might get overtime, commission and bonuses, some if it being ‘regular’.

These can present some of the most complex cases when calculating holiday pay because organisations often run into issues when defining what’s considered ‘regular’ with this type of pay.

In other words, you should only really be including ‘regular’ overtime as part of your calculations that’s been paid out the last 52 weeks. Overtime once every few months or so, doesn’t really count, but when it’s on a regular, almost monthly basis, then it does. As an employer, it can be tricky to draw a line in the sand, so it’s important that you use your judgement here to figure out what’s ‘reflective’ of that employee's situation.

As with the other examples in this list, you’d add up that employee’s remuneration over the last 52 weeks, including any regular overtime, bonuses or commissions and divide that by 52 to work out their ‘normal’ weekly pay.

If the last 52 weeks look a bit abnormal in terms of additional pay they’ve received, you can always look to use a different pay period, but this is something you’ll need to work out with the employee.

Fixed hours, but different hourly rates of pay

This applies especially to shift workers where different shifts can often lead to different rates of hourly pay. In this case, your holiday pay calculations will look slightly different.

Add together the employee’s total remuneration for the last 52 weeks worked (regular overtime, commissions and bonuses included) and then divide this figure by 52 for average weekly pay.

If you want to figure this out based on hours, use total working hours instead over that period and divide by 52 for the average weekly hours.

Divide the average weekly pay by the average weekly hours to get the average hourly rate of pay.

You can then use this rate to calculate their holiday pay.

Fixed hours on a piecework basis

A less common working arrangement, though one you may still run into, is that of an employee getting paid for the number of tasks they complete. In this situation, you’ll want to work out the average hourly rate and multiply that by the number of hours holiday taken to get their holiday pay.

Rolled-up holiday pay

There’s been a lot of back-and-forth on whether or not rolled-up holiday pay should be legal. During the latest government consultation, it was confirmed that rolled-up holiday pay will indeed be a lawful method for calculating holiday pay from the new tax year. So this is a method employers can now apply to calculate pay for part-term and irregular-hour workers.

Holiday pay cases in law

There have been several cases in recent years that have looked to highlight the issues surrounding holiday pay.

Lock vs British Gas

One of the most prominent was Lock vs British Gas. The dispute centred on Mr Lock, a sales consultant for British Gas, who claimed that he was owed money on the basis that his holiday pay was not reflecting what he would have earned from the results-based commission.

The Court of Appeal’s ruling in October 2016 stated that holiday pay must include compensation for any results-based commission that would have been ordinarily earned by a worker.

Bear Scotland vs Fulton

Another prominent case regarding holiday pay is Bear Scotland v Fulton.

Mr Fulton claimed that Bear Scotland Ltd had made unjustified deductions from his wages by not including overtime and other payments associated with his work in calculating holiday pay due to him.

The courts agreed, and the Employment Appeal Tribunal (EAT) ruled in November that 2014 that regular overtime, which employees are required to perform if requested to do so by their employer, should be included for holiday pay purposes.

Harpur Trust vs Brazel

The Harpur Trust v Brazel was another significant case. The court ruled that holiday pay for staff employed to work only part of the year should be calculated using an employee’s average earnings over a 12-week period and not pro-rated.

What are the issues?

Not all employees are paid weekly, so how does an employer running a monthly payroll convert their historical data into weekly pay? The HMRC guidance, while okay, is not exhaustive—nor does it allow employers to simply divide employee earnings and hours by 12 months.

For variable paid employees who are paid monthly, employers need to start keeping weekly pay records to enable them to calculate holiday pay correctly. This is because the historical process of just paying accrued annual leave to variable-paid workers every month, often referred to as “rolled-up holiday pay”, is no longer seen as an accepted method for managing annual leave in the eyes of HMRC.

PayFit makes holiday pay calculations a doddle

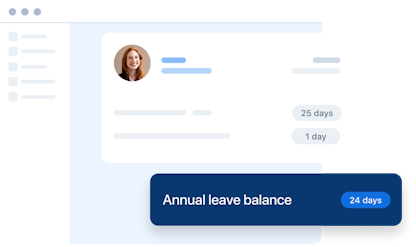

Holiday pay can be confounding, but with PayFit, you can make it easy.

Most payroll software and bureaus don’t cover calculating holiday pay - they often exclude it from their packages or don’t have the proper technical infrastructure to automate this.

With PayFit, you can instantly look back up to 104 weeks to retrieve 52 weeks of pay you can use. Our platform then calculates the average daily rate for you. No more combing through spreadsheets or performing calculations by hand; simply switch on the toggle - at the company level or employee level - and we’ll take care of the rest!

Plus, we offer a suite of features to empower employees to manage their leave - so they can log it and watch their payslips update in a flash. Leave and pay becomes more transparent as employees can view breakdowns of their calculations and rates in their PayFit employee portal.

The 2024 UK National Living Wage - An Employer’s Guide

The Cost Of Recruitment In The UK - What You Might Not Know

UK National Insurance Changes for January 2024

End Of Tax Year 2023/2024 - Eight Key Changes For 24/25

Strategies to Reduce Employee Turnover