- Blog

- |People management

- >Salaries & Benefits

- >Salaries during and after coronavirus

Salaries during and after coronavirus

Pre-COVID – a constant challenge

In our study, over a quarter of HR managers in the UK identified employee salary as one of the four most urgent challenges of 2020.

All in all, not a huge surprise.

Salary is always a contentious subject for both employees and employers. The former expects to enjoy year on year increases, while the latter is always striving to offer a fair yet competitive package. This can make finding a happy medium a lot easier said than done.

While pay levels have generally increased throughout the last five years, the economic impact of the pandemic has forced many companies to reevaluate their salary policy. According to the Office for National Statistics (ONS), this has resulted in the sharpest decrease in average pay for UK employees in two decades.

Financial vulnerability and increased education

The pandemic hit society's poorest the hardest with those in lower-paid jobs the most likely to have been left unemployed. Research by the Resolution Foundation revealed that lower earners were up to three times more likely to have been placed on furlough leave and that 1.2 million were working in precarious positions.

Alone it is a worrying fact, but when other research is taken into account, it becomes apparent that the coronavirus pandemic has the potential to inflict untold damage and misery on millions of financially vulnerable people.

Did you know?

Fifty per cent of UK adults were already considered financially vulnerable by the Financial Conduct Authority(FCA) back in 2018.

The Money and Pensions Service released its UK Strategy for Financial Wellbeing at the beginning of the year in which it set out its 10-year vision to improve the financial wellbeing of millions of people. One startling revelation was that 11.5 million Brits have less than £100 in savings.

A more recent survey from the Financial Conduct Authority also showed that 12 million Brits would struggle to pay bills as a result of the pandemic.

Figures like these have revealed just how vulnerable people are and has led to many companies making a more concerted effort to increase awareness of financial wellbeing issues.

Companies such as Mintago, a financial wellbeing platform that helps employees to become more financially confident, have become increasingly popular with employers looking to broach the subject of employee financial wellbeing.

Mintago’s service focuses on educating employees and also acts as a planning tool that helps support employees in achieving their long-term goals.

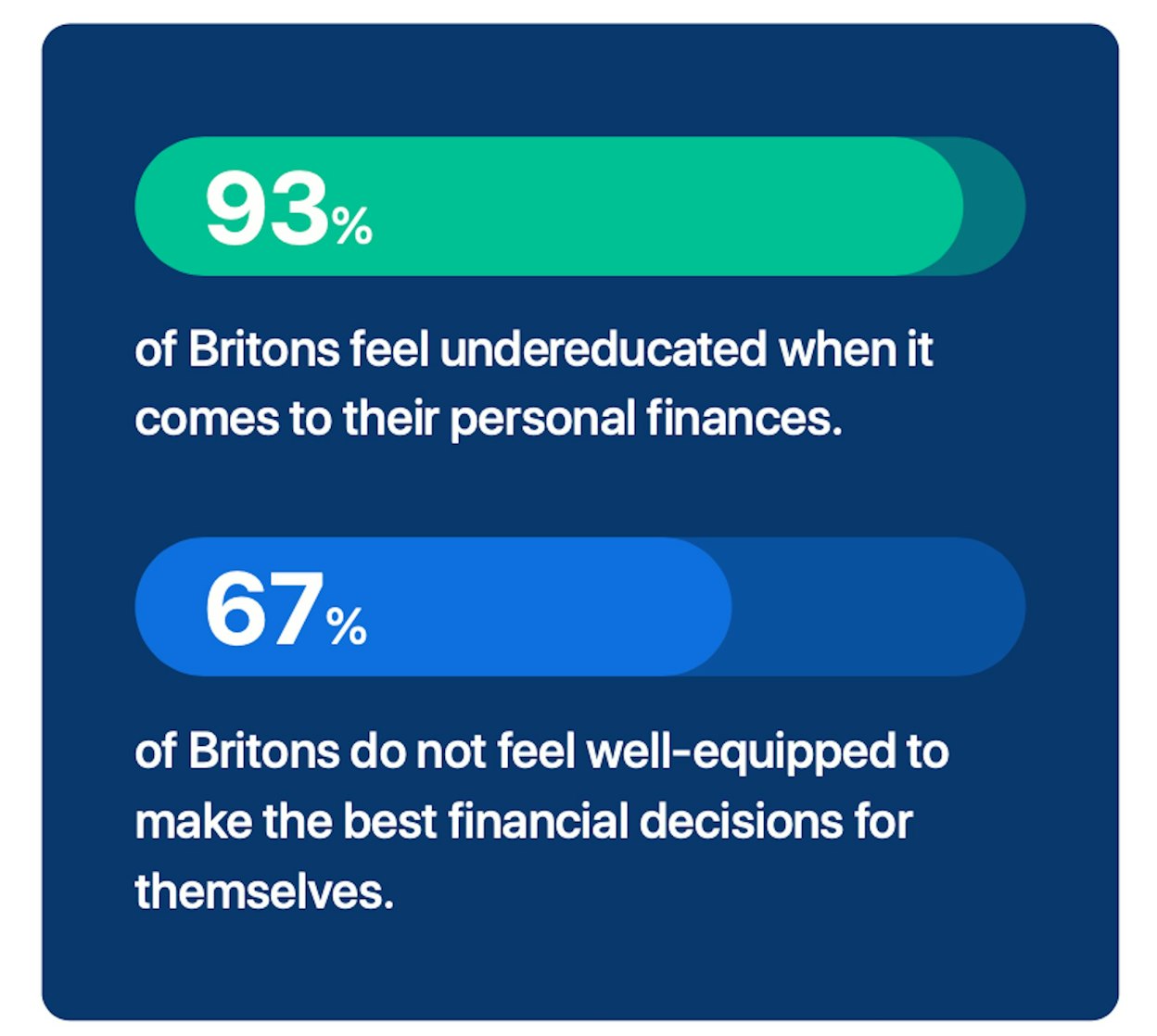

The topic of "financial education" is undoubtedly an important one. The glaring absence of financial management from the school curriculum is almost certainly responsible for the lack of understanding.

A 2019 survey published by the Financial Times revealed that an astonishing 80% of UK students aged 15-18 felt that they were not taught enough practical finance lessons in schools.

The lack of education in schools, and the subsequent absence of reliable guidance, has often meant that financial education takes place in the form of negative life experiences.

This is particularly evident with young adults who, after entering the working world and being exposed to money for the first time, are more likely to focus on short-term spending rather than longer-term saving.

Another service that employers are looking to offer employees is access to Employer Salary Advance Schemes (ESAS) such as Hastee and Wagestream.

These services offer a safer alternative to the likes of overdrafts, credit cards and payday lenders. However, they are not without their fallibilities.

When used in the right way, schemes such as these can help employees to deal with unforeseen expenses and occasional short-term cash flow problems; however, they can also become something that people overly rely on and lead to a negative cycle.

“Payday spending sprees and impulse purchases are one of the leading causes behind 25-34-year-old Brits living deep into their overdraft.

“It’s not about how much income your team is earning, but how they’re effectively budgeting and managing their spending. The end of month squeeze is avoidable if they have access to the right strategies and the know-how to implement them in their own circumstances.”

Chieu Cao, Founder & CEO at Mintago

Bridge the financial health gap and provide your employees with the support they really need with Mintago's free personalised, company-wide financial health assessment.

Salary trends during the pandemic

A survey by McGregor Boyall reported that for 62% of the 1,200 employers they surveyed, salaries were holding at pre-pandemic levels, while 16% had reported reduced salaries.

According to research by Korn Ferry, a recruitment and consulting firm, a quarter of employers had implemented or were considering implementing, pay reductions in May. The survey also revealed that employers were debating whether to cancel or defer salary increases, adjusting variable pay and performance-based commission and cancelling bonuses.

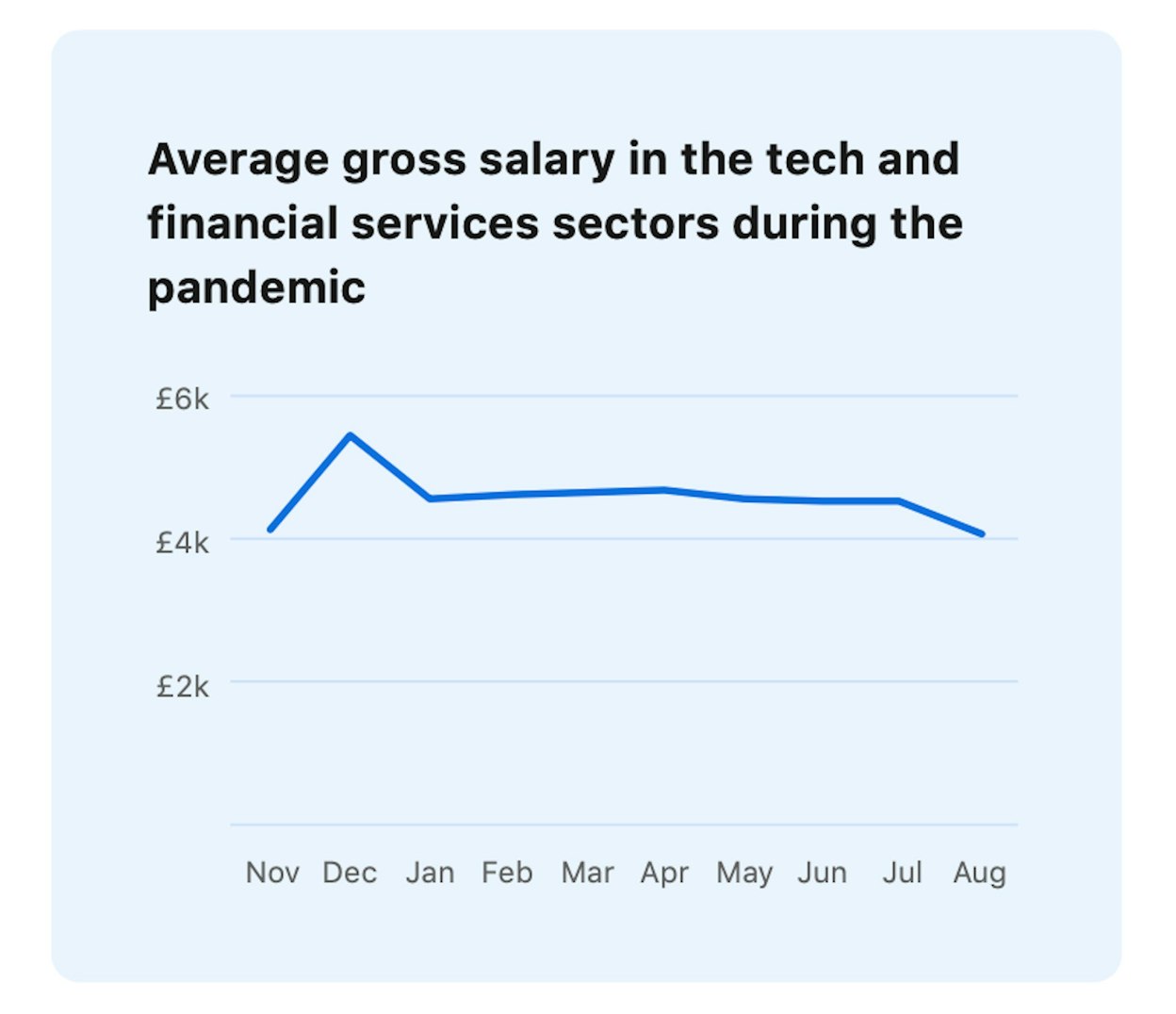

Being a payroll provider, we chose to conduct our own internal investigation by picking 3,000 random and anonymised employees from our customer database.

PayFit’s customer demographic

PayFit's customer demographic is primarily made up of small and medium businesses operating in the tech or financial services sector. Most companies currently operate in and around the Greater London area.

The results revealed definite trends in the ways employers approached salary issues during the pandemic.

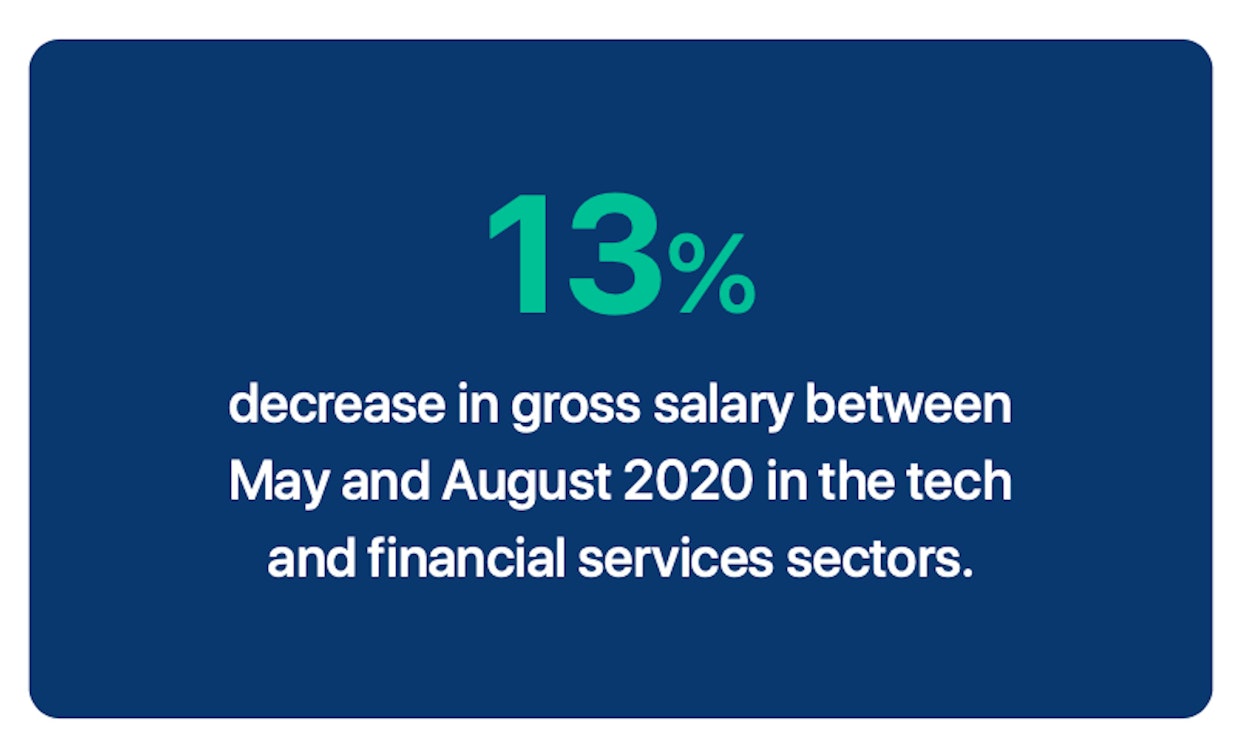

Although gross salaries remained reasonably stable throughout the pandemic in the tech and financial services sectors, there was a slow down in terms of salary increases in June, while salaries began to fall between May and August, with the sharpest decline between July and August.

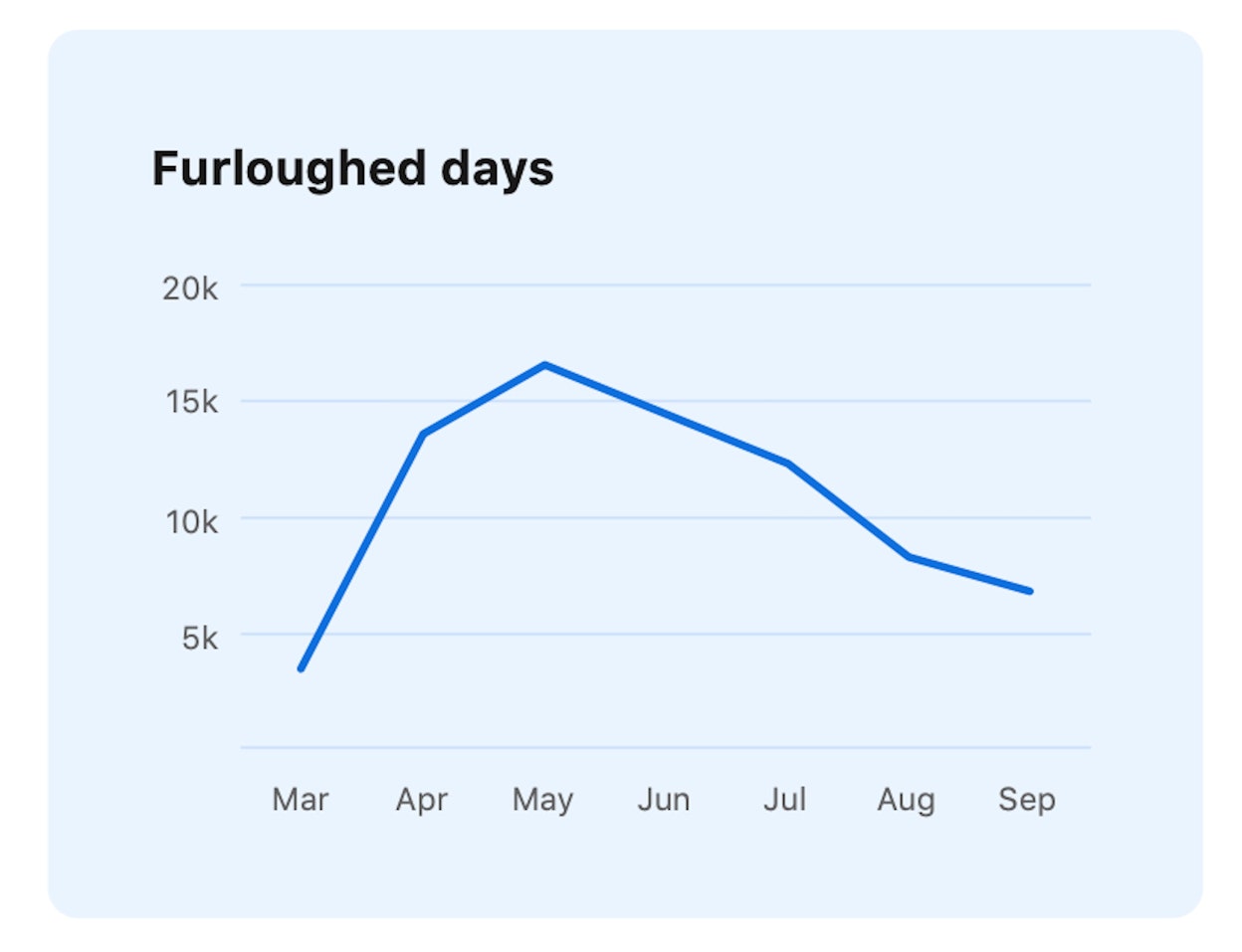

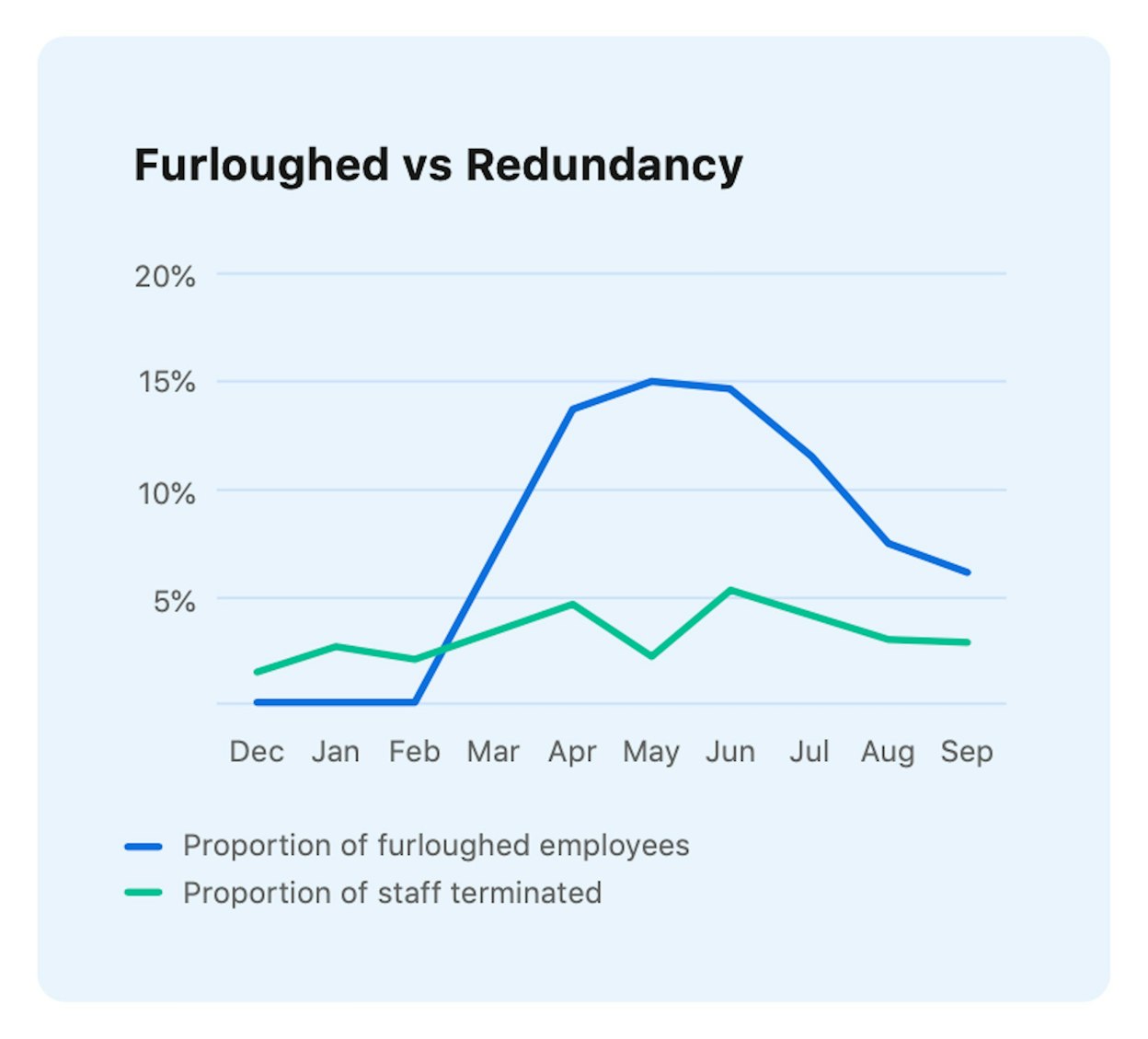

The data also revealed some interesting insights into the ways that companies furloughed employees. Unsurprisingly, total furloughed days were at their highest at the end of April and beginning of May. After this point, they decreased month on month.

However, as the number of furloughed days decreased, the number of redundancies increased, almost certainly due to the reduction in government contributions between August and October.

While 15% of employees in our sample were on furlough in June 2020, the proportion of employees terminated was also at its highest at just over 5%.

Recognition and rewards

Although sometimes unavoidable, furlough and redundancy are often the last resort for organisations.

Nevertheless, during the pandemic, many businesses have looked to find innovative ways of deferring or avoiding them altogether.

Some opted to introduce fewer working hours or even cut the length of the working week. Others took a more radical approach and gave employees significant holiday entitlement, albeit at a drastically reduced rate of pay.

There were even cases where employers offered employees stakes in the business as a way of encouraging ownership and employee loyalty.

Measures like those mentioned above can certainly help reduce the financial burden in the short term while increasing the chances of employees remaining with the company in the long term.

However, for HR departments, pay and salary are a balancing act. On the one hand, employers have had to be vigilant and monitor spending and, on the other, have had to maintain employee morale and avoid widespread disillusionment.

This balancing act has been particularly challenging to manage when trying to measure the performance of employees whose jobs and targets have been severely impacted by the pandemic.

Those hardest hit have been employees on variable pay or those whose salaries are heavily incentivised by bonuses. To counterbalance this, many employers have chosen to readjust long-term goals and targets for affected employees and even reevaluate the metrics used for measuring performance.

Employee salary in the future

Typically, in situations like this, people look to analyse past or similar experiences. The problem is, the current situation cannot be compared to anything that has preceded it.

No company, HR team or individual has ever lived through a crisis of this nature and, as a result, "What next?" is an incredibly difficult question to answer.

When it comes to salaries and employee pay, we can draw only tenuous comparisons between the current crisis and what happened after the 2008 financial crash.

Analysis carried out by the Institute for Fiscal Studies (IFS) in 2018 revealed that people in their 30s were earning £2,100 a year less than people in the same age group in 2008. This could well happen again.

Many employees, particularly those in junior roles or entering the job market for the first time, are likely to experience pay freezes and bonus cuts in both the short and long term.

What is certain is that during the last six months, companies have reacted in very innovative ways and it is likely that organisations will continue to experiment with controlling employee salary in the future.

One such way is through the implementation of remote work as a long-term solution.

Some companies have decided to become 100% remote and told employees that they would no longer be required to work in offices even when the pandemic comes to an end.

On the face of it, working remotely should not affect how much someone earns. But companies have added a caveat—if employees are keen on remote working, and want to do so away from the towns or cities in which their company operates, they must be willing to have their pay adjusted accordingly.

This is what Facebook is preparing to implement from the start of 2021 through readjusting the pay of employees moving away from the company’s California base. Facebook’s approach is a pretty drastic one, and there are already sceptics who believe that it will be a difficult policy to implement.

While this may be one way of dealing with employee salaries post-pandemic, the more global issue relates to the way that employers approach employees’ financial wellbeing.

If there is one positive to take from the current situation, it is that employers do seem increasingly aware of the importance of assuring employees' financial wellbeing. In the future, the hope is that as organisations recover, they will have effective protocols and procedures in place to help educate and support employees and ensure their long-term financial health.

The 2024 UK National Living Wage - An Employer’s Guide

The Cost Of Recruitment In The UK - What You Might Not Know

UK National Insurance Changes for January 2024

End Of Tax Year 2023/2024 - Eight Key Changes For 24/25

Strategies to Reduce Employee Turnover