- Blog

- |People management

- >Pensions

- >Pension contributions

Three factors that can impact pension contributions and how PayFit can help

National Payroll Week has started, and of course, we are celebrating all the payroll professionals out there! In the payroll world, pension schemes are a key element.

We have previously written about five things everyone should know about their pension. This article explains factors that may impact an employee’s pension contributions and how PayFit can help organisations set up and manage pension schemes.

Who has to contribute to a pension scheme?

Anyone between the age of 22 and the state pension age, earning a minimum of £10,000 per year, and working in the UK must be enrolled in a pension scheme with a minimum contribution of 8%, 3% of which must be contributed by the employer.

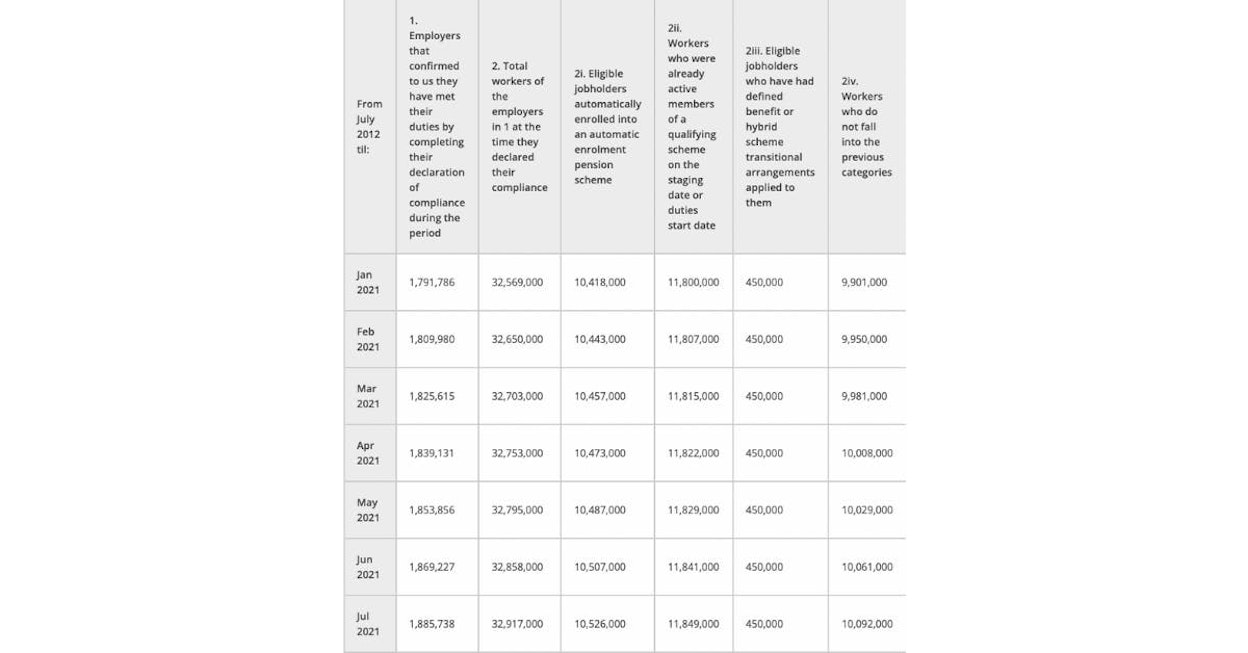

The number of employees enrolled in a pension scheme used to be less than 2.5 million when auto-enrolment started; however, in 2021, over 20 million people are now enrolled in a pension scheme.

When we covered the facts about the pension scheme in our previous article, we briefly touched on salary sacrifice. Here, we go into more detail about salary sacrifice and how it can impact pension scheme contributions.

What is salary sacrifice, and is it suitable for all?

A popular way of contributing to a pension scheme is through salary sacrifice, which means that the employee gives up part of their gross salary, and the employer pays this straight into their pension. In most cases (and the main reason salary sacrifice is so popular), both the employee and employer will pay less tax and National Insurance.

Salary sacrifice may not be appropriate for all employees, though. As salary sacrifice deductions reduce gross pay, this also reduces the pay for National Minimum Wage (NMW) purposes, so employers need to be mindful when operating a salary sacrifice scheme that employees are not taken below NMW. If this does happen, an employer might agree to pay more than the minimum amount required to cover some or all of the employee’s pension contribution, or the employee may be offered an alternative way of contributing to the scheme.

It’s important to note that statutory payments and furlough pay cannot be sacrificed, meaning employers will likely need to cover the sacrificed amount during these periods. Salary sacrifice arrangement also means changing the terms of an employment contract and can also impact entitlements to statutory payments.

How do statutory leaves impact pension contributions?

So, we now know how salary sacrifice impacts pension contributions, but what about when employees take statutory leave? During paid statutory leave such as statutory maternity, statutory paternity or statutory adoption leave, the employer and the employee need to carry on making pension contributions.

The employee’s contributions will be based on statutory pay received and may be less than they would normally contribute. Still, the employer pays contributions based on the employee’s salary as if they were not on leave.

Does being on furlough impact pension contributions?

Now, after looking into traditional statutory leave, we can’t leave out the impact of the new “F-word” that has been on everyone’s lips these past 18 months, Furlough!

Furlough has been one of the most significant changes in UK payroll legislation for many years. This time last year, we saw over 2.5 million employees within the workplace pension age bracket receiving a proportion of their wage through the Coronavirus Job Retention Scheme. Three months earlier, the figure was over three times higher at a staggering 8 million employees. But what impact did being on furlough have on pension contributions? Pension contributions were based on furlough salary, or what was previously contractually agreed, which means employees on furlough may have paid less into their pension and that the employers may have contributed less.

It’s important to note that employers still had to pay at the agreed rate, i.e. 3% if 3% was contractually agreed, based on the same earnings threshold.

How does PayFit help businesses with pension scheme management?

There are many things that employers need to take into account when it comes to a pension scheme, such as whether it will accept their staff, how much it will cost, whether it uses the best tax relief method and whether it will work with their payroll process. To keep things a little easier, here is how PayFit can help.

PayFit handles a wide range of pension providers

PayFit completely manages the addition of new joiners to a scheme, the company’s monthly contributions and the process of leavers for a large majority of pension providers. All the employers need to do is enter their employees into the pension scheme in the software, and the rest is handled by PayFit automatically.

For a minority of pension providers that PayFit doesn’t integrate with, we provide our customers with a file that they can upload directly to their pension provider’s website.

If the pension scheme used by your organisation is not listed below, it doesn’t mean that you’re unable to use it with the PayFit software; it simply means that there is currently no integration in place. Your organisation can use PayFit and manage the pension scheme on its own.

Pension Providers

NEST

The People's Pension

Smart Pension

AVIVA

Royal London

Legal & General

Scottish Widows

Standard Life

True Potential

AEGON

2. Auto-enrolment is automated in PayFit.

PayFit software carries out an employee’s automatic enrolment assessment based on the employee’s age, employment type and earnings to determine whether or not they are an eligible, non-eligible or entitled worker.

If the employee is eligible, the employer will be asked to add the employee to a pension scheme (or postpone for up to a maximum of three months), with at least a 3% employer and a 5% employee contribution.

Suppose an employee is not eligible for a particular month. In that case, PayFit will continue to assess their status on a month-to-month basis until they become eligible and generate mandatory communications.

3. Salary sacrifice is easily managed in PayFit.

While salary sacrifice is a tax-efficient and cost-effective way of deducting both employee and employer pension contributions, some employers find it daunting and prone to errors. With PayFit, setting up a salary sacrifice scheme is easy, and calculations are automatic, considering all variables impacted.

Interested in finding out more? Why not book a call with one of our product specialists?

PayFit disclaimer

The information contained in this document is purely informative. It is not a substitute for legal advice from a legal professional.

PayFit does not guarantee the accuracy or completeness of this information and, therefore, cannot be held liable for any damages arising from your reading or use of this information. Remember to check the date of the last update.

The 2024 UK National Living Wage - An Employer’s Guide

The Cost Of Recruitment In The UK - What You Might Not Know

UK National Insurance Changes for January 2024

End Of Tax Year 2023/2024 - Eight Key Changes For 24/25

Strategies to Reduce Employee Turnover